If you’re considering buying a home or refinancing your existing mortgage, one of the most critical factors you’ll encounter is the mortgage rate. Mortgage rates determine the amount of interest you’ll pay over the life of your loan, impacting your monthly payments and overall affordability. In this article, we’ll delve into everything you need to know about finding the best home mortgage rates today.

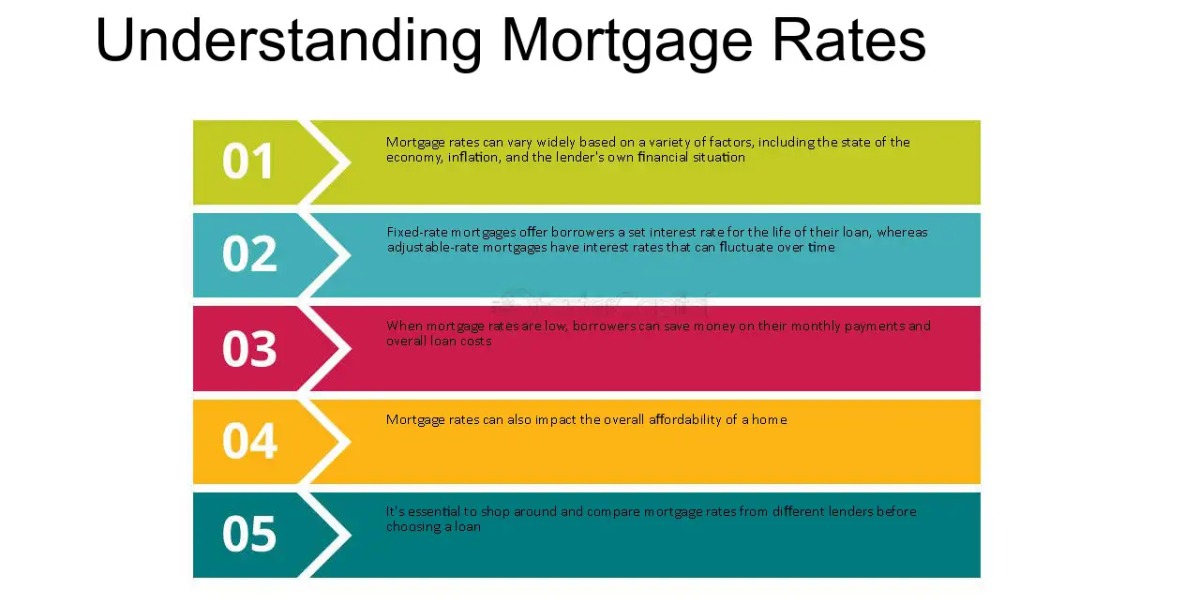

Understanding Home Mortgage Rates

Mortgage rates refer to the interest charged on a home loan. They fluctuate based on various economic factors and can vary between lenders. Mortgage rates are typically expressed as an annual percentage rate (APR), representing the cost of borrowing over a year.

Importance of Finding the Best Rates

Securing the best home mortgage rate can save you thousands of dollars over the life of your loan. Even a small difference in interest rates can significantly impact your monthly payments and long-term financial health.

Factors Influencing Mortgage Rates

Several factors influence mortgage rates, including economic indicators like inflation, unemployment rates, and the overall health of the economy. Additionally, factors such as loan term, loan amount, and your credit score can affect the rate you’re offered.

How to Compare Mortgage Rates

Comparing mortgage rates from different lenders is essential to find the most competitive offer. Use online comparison tools, consult with multiple lenders, and consider both the interest rate and associated fees when evaluating your options.

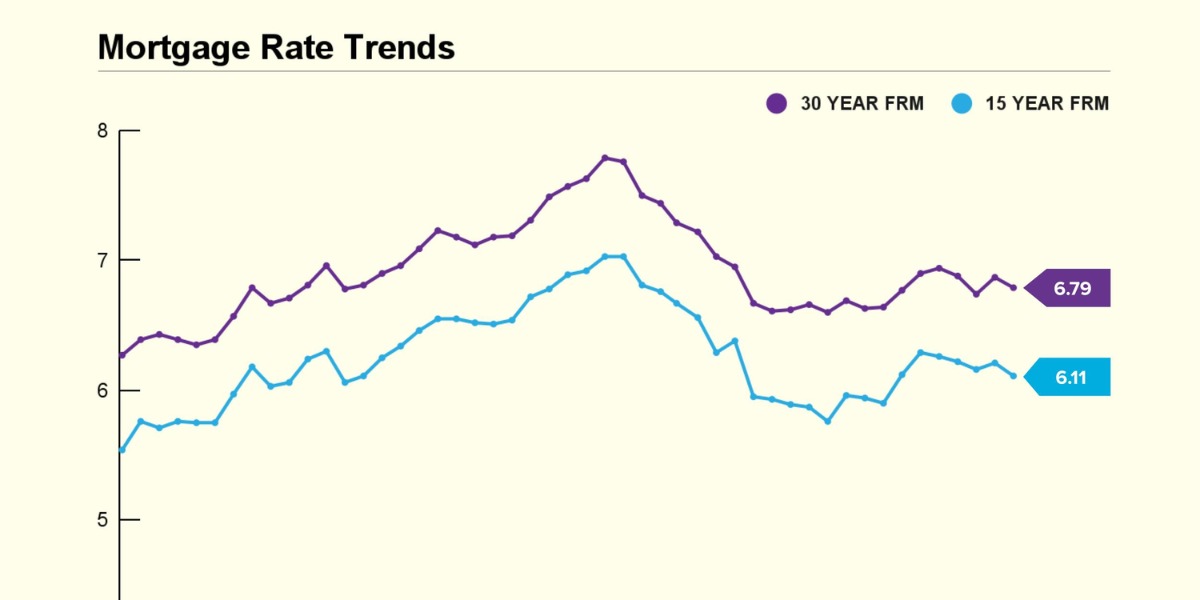

Researching Current Mortgage Rates

Stay informed about current mortgage rates by regularly checking financial news websites, lender websites, and mortgage rate comparison platforms. Keep in mind that rates can fluctuate daily based on market conditions.

Tips for Getting the Best Home Mortgage Rates

To improve your chances of securing the best home mortgage rates, focus on improving your credit score, saving for a larger down payment, and shopping around for the most favorable terms. Additionally, consider working with a reputable mortgage broker who can help you navigate the process.

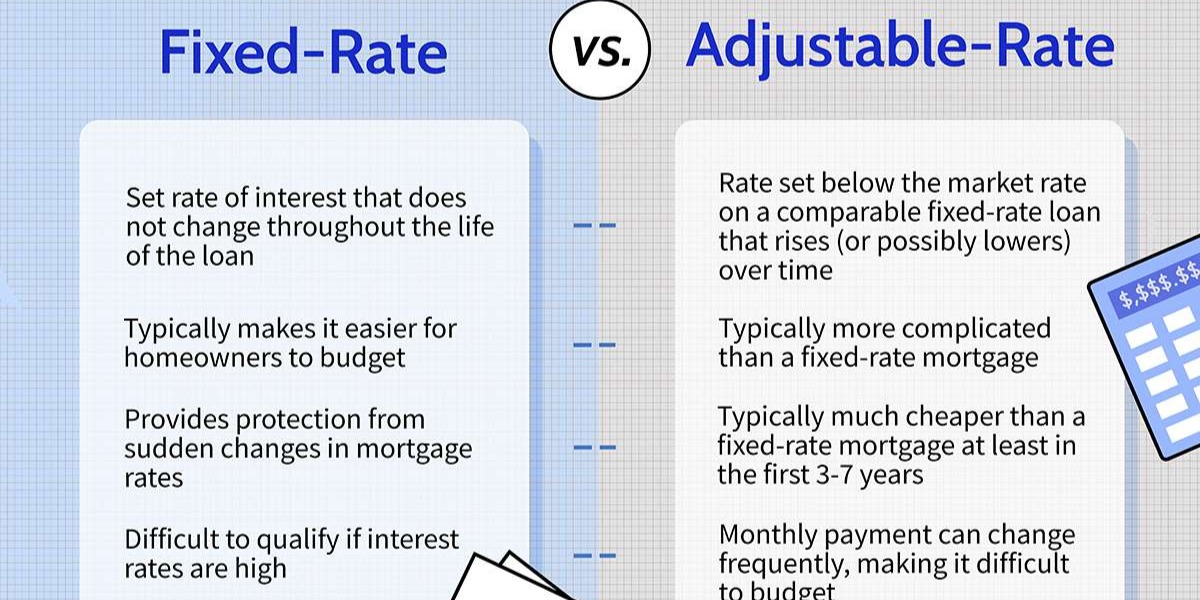

Fixed vs. Adjustable Rate Mortgages

When choosing a mortgage, you’ll encounter two primary types: fixed-rate and adjustable-rate mortgages (ARMs). Fixed-rate mortgages offer stable monthly payments, while ARMs typically start with lower rates but can fluctuate over time.

The Role of Credit Score in Mortgage Rates

Your credit score plays a significant role in determining the mortgage rate you qualify for. Lenders use your credit score to assess your creditworthiness, with higher scores typically resulting in lower interest rates.

Mortgage Rate Locks: What You Need to Know

Once you’ve found a favorable mortgage rate, consider locking it in to protect against potential rate increases before closing. Mortgage rate locks typically last for a specified period, giving you time to finalize the loan process.

Government Programs for Lower Mortgage Rates

Explore government-backed mortgage programs, such as those offered by the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA), which often provide competitive rates and more flexible qualification requirements.

Working with a Mortgage Broker

A mortgage broker can help simplify the mortgage shopping process by connecting you with multiple lenders and negotiating on your behalf. Be sure to choose a broker with a solid reputation and industry expertise.

Avoiding Common Pitfalls in Mortgage Rate Selection

Avoid common pitfalls such as focusing solely on the interest rate without considering other loan terms, neglecting to factor in closing costs, or failing to thoroughly review the loan estimate provided by the lender.

Securing Your Ideal Home Mortgage Rate

Finding the best home mortgage rates today requires diligence, research, and careful consideration of your financial goals and circumstances. By understanding the factors influencing mortgage rates, comparing offers from multiple lenders, and seeking guidance from professionals, you can secure a mortgage that aligns with your needs and budget, setting you on the path to homeownership with confidence.

Click here for more visited Posts!