Are you planning to buy a house in Ontario? Securing the best mortgage rates can save you thousands of dollars over the life of your loan. But navigating the complex world of mortgages and interest rates can be daunting. In this guide, we’ll break down everything you need to know about getting the best mortgage rates in Ontario, while adhering to Google SEO rules.

Understanding Mortgage Rates in Ontario

Mortgage rates refer to the interest you pay on your home loan. In Ontario, these rates can vary based on several factors, including the lender, market conditions, and your financial profile.

Factors Affecting Mortgage Rates

Numerous factors influence mortgage rates in Ontario. These include the Bank of Canada’s overnight rate, inflation, economic growth, and global financial markets. Lenders also consider your credit score, down payment amount, and debt-to-income ratio when determining the rate you qualify for.

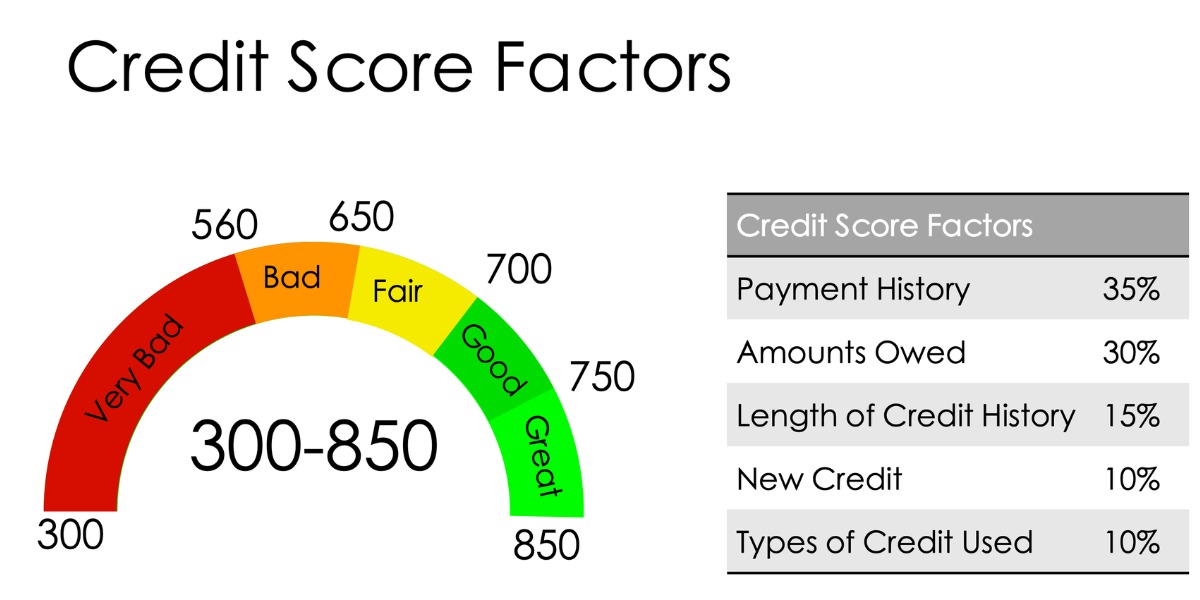

Importance of Credit Score

Your credit score plays a crucial role in determining the mortgage rate you’re offered. Lenders use this score to assess your creditworthiness. A higher credit score usually translates to lower interest rates, so it’s essential to maintain a good credit history.

Types of Mortgages Available

In Ontario, homebuyers can choose from various mortgage options, including fixed-rate mortgages, variable-rate mortgages, and hybrid mortgages. Each type has its pros and cons, so it’s essential to understand which one aligns best with your financial goals.

Shopping Around for the Best Rates

Don’t settle for the first mortgage offer you receive. Shopping around and comparing rates from different lenders can help you secure the best deal. Online comparison tools and mortgage brokers can assist you in finding competitive rates.

Mortgage Broker vs. Bank: Pros and Cons

Deciding between using a mortgage broker or going directly to a bank is a crucial step in the mortgage process. While banks offer convenience, mortgage brokers can provide access to a broader range of lenders and potentially better rates.

Tips for Improving Your Credit Score

To qualify for the best mortgage rates in Ontario, focus on improving your credit score. Pay your bills on time, keep credit card balances low, and avoid opening new credit accounts before applying for a mortgage.

Down Payment and Its Impact on Rates

The size of your down payment can influence the interest rate you’re offered. A larger down payment typically results in a lower rate, as it reduces the lender’s risk.

The Role of Debt-to-Income Ratio

Lenders consider your debt-to-income ratio when assessing your mortgage application. Aim to keep this ratio below 43% to qualify for competitive rates.

Negotiating with Lenders

Don’t be afraid to negotiate with lenders to secure a better rate. If you have a strong financial profile, lenders may be willing to offer you a lower rate or waive certain fees.

Fixed vs. Variable Rates: Which is Better?

Choosing between a fixed-rate and a variable-rate mortgage depends on your risk tolerance and financial circumstances. Fixed rates offer stability, while variable rates can fluctuate with market conditions.

Government Programs and Incentives

In Ontario, various government programs and incentives aim to help first-time homebuyers access affordable mortgage rates. Research available options to see if you qualify for any assistance.

Seeking Professional Advice

Navigating the mortgage market can be complex, so don’t hesitate to seek advice from professionals. Mortgage brokers, financial advisors, and real estate agents can offer valuable insights and guidance throughout the process.

In securing the best mortgage rates in Ontario requires careful consideration of various factors, including your financial situation, credit score, and market conditions. By understanding these key aspects and following the tips outlined in this guide, you can position yourself to find the most favorable mortgage terms for your needs.

Click here for more visited Posts!